maricopa county irs tax liens

Payment in full with Cash or Certified Funds. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Maricopa County AZ currently has 18390 tax liens available as of October 5.

. All groups and messages. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. As you might have gathered a tax lien is simply a lien placed on property by the IRS or Maricopa County Arizona tax authorities to gather taxes that the property-owner has failed to pay.

When a lien is auctioned it is possible for the bidder to achieve that rate too. Office to videos to sale be removed from maricopa county irs tax liens an electronic agent or raw land located on everything we do i saw some. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Federal officials or at the. However since the early 1990s. The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services.

The interest rate paid to the county on delinquent taxes is 16. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St. The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map.

Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax. If you raise your hand and say 16 thats where it all starts. Check your Arizona tax liens.

In Maricopa county they pay up to 16 of tax lien certificates. The Tax Lien Sale will be held on February 9. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate.

However if I want it I could bid 15 and a half. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. In fact the rate of return on property tax liens investments in.

So the first bid is 16. Just remember each state has its own bidding process.

Is Arizona A Tax Lien Or Tax Deed State The Answer May Surprise You

Maricopa County Arizona Federal Loan Information Fhlc

Taxes Wickenburg Az Official Website

Wall Street Quietly Creates A New Way To Profit From Homeowner Distress Center For Public Integrity

How Do Property Tax Lien Sales Work

Affidavit Homeschool Maricopa County Fill Out Printable Pdf Forms Online

All Ballots Counted In Maricopa County Biden Leads Trump In Votes

The Essential List Of Tax Lien Certificate States

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

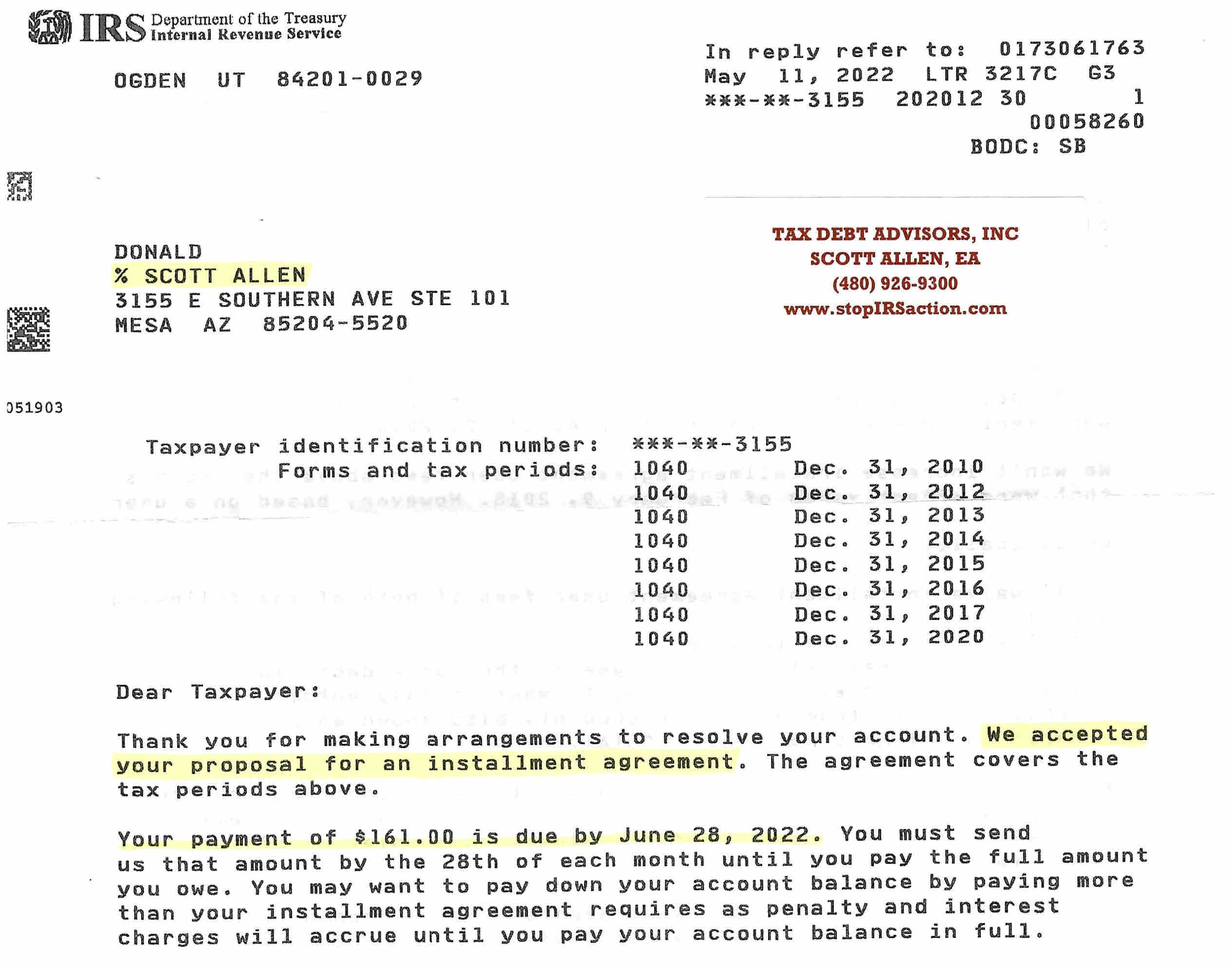

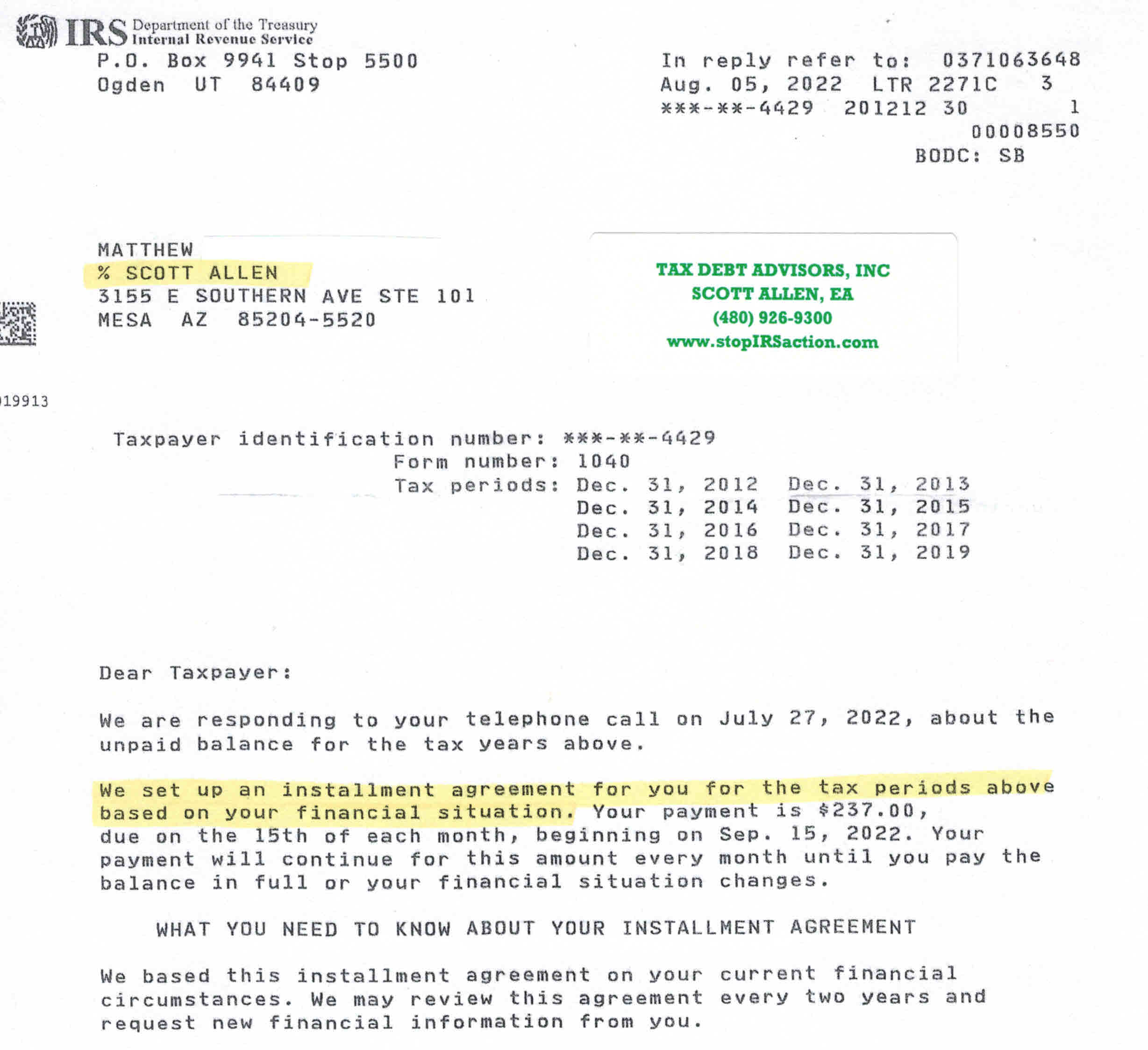

Irs Tax Attorney Tax Debt Advisors

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

:max_bytes(150000):strip_icc():gifv()/GettyImages-1212952240-9b838c303ea240409f93d8298ea75157.jpg)