charitable gift annuity tax reporting

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. However for 2021 individuals who do not itemize their deductions may deduct up to 300 600 for married individuals filing joint returns from gross income for their qualified cash charitable.

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Learn some startling facts.

. The amount entered in Box 3 with code F will transfer to Schedule D Line 8 as Form 1099-R. The maximum number of annuitants is two and payments can be made to them jointly or successively. A gift annuity offers immediate tax relief and.

If a donor makes a gift of cash to fund a gift annuity a portion of each distribution from the annuity is taxed as ordinary income and a portion of the annuity is a tax-free return of principal. The donor will receive a charitable income tax deduction for the value of the gift element of the contribution. Distribution code drop-down then click Continue.

In exchange the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies. How are charitable gift annuity contributions reported externally. But like any income your annuity payments are subject to taxation.

The following instructions will ensure the capital gains amount is taxed at the lower rate it is eligible for. The payment of the income is a legal obligation of the charity and is guaranteed. Note that any link in the information above is.

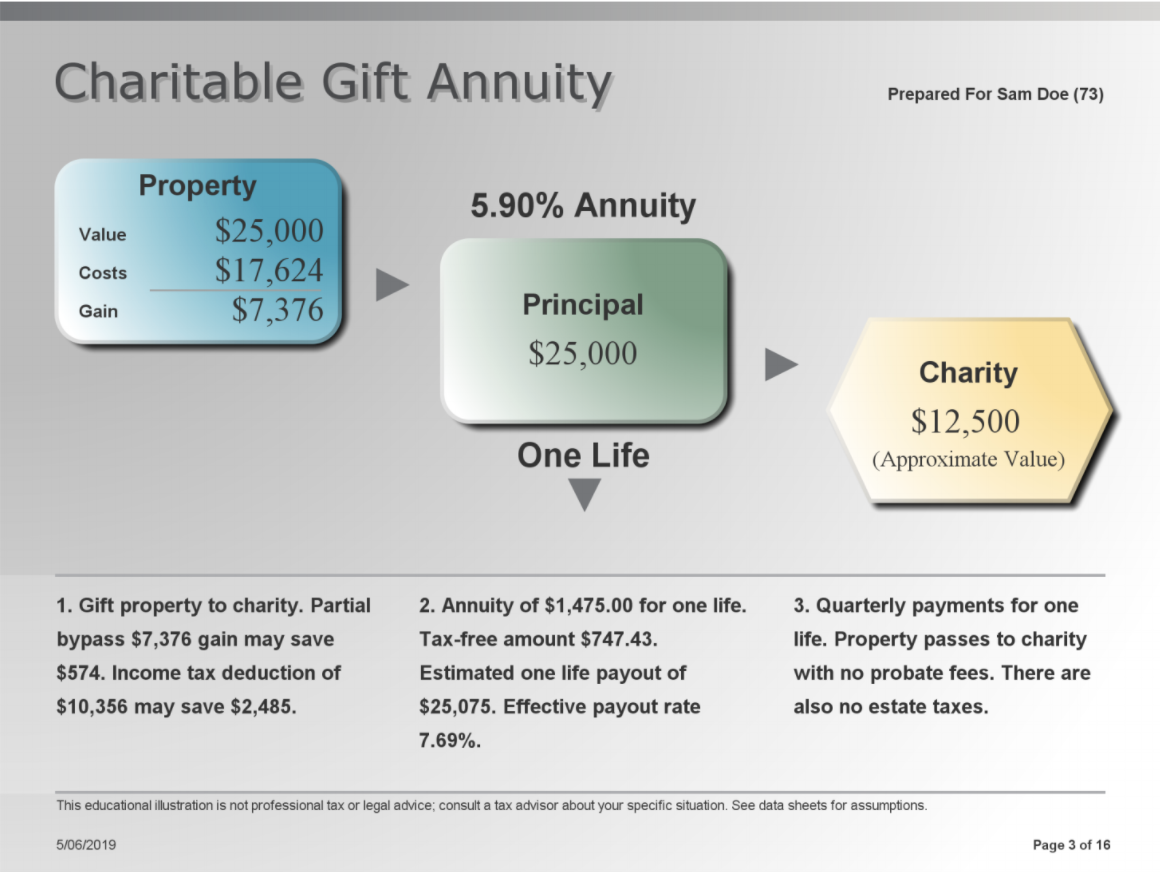

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. 11 rows The payments you receive from a charitable gift annuity are tax-free and can help supplement. Fixed Payments Eliminate The Impact Of Market Volatility.

The rules can be complex so consider discussing the specifics of your situation with a tax advisor. Charities must use the gift for a specific initiative if the donor specified one when they made the donation. Ad Annuities are often complex retirement investment products.

If cash or capital gain property is donated in exchange for a charitable gift annuity report distributions from the annuity on Form 1099-R. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Some of the contribution is to purchase an annuity the right to receive lifetime income and that portion is not tax deductible.

The value of the charitable remainder interest in a unitrust or annuity trust is not subject to gift tax. If you receive income from charitable gift annuities reported on Form 1099-R the amount reflected in Box 3 will report the capital gains that are already included in the taxable amount reported in Box 2a of the form. Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the general funds of the charity a gift tax charitable deduction is allowed under 252552a-1 of the Gift Tax Regulations for the amount transferred to the charity that. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. The division of the interests in the annuity between the charitable and non-charitable interests is critical in determining how the annuity will be taxed.

The non-charitable portion is not deductible. However there is a potential tax drawback of a charitable gift annuity. Form 1099-R - Charitable Gift Annuity Code If you receive income from charitable gift annuities reported on Form 1099-R the amount reflected in Box 3 Capital gain included in Box 2a will report the capital gains that are already included in the.

However the donor must report the remainder gift regardless of. Report Inappropriate Content. If you have already entered some charitable donations click on Add Another Charity.

Charitable gift annuity contributions are reported as deferred giving in section 3c of the survey along with charitable. This is the amount that should be reported on Form 8283 as a charitable deduction. However such conservative rates may discourage all but the most philanthropically minded.

A charitable gift annuity CGA is a contract under which a 501 c 3 qualified public charity in return for an irrevocable transfer of cash or other property agrees to pay the annuitant s a lifetime income. In TurboTax online in the Federal section go to Deductions Credits scroll down to Charitable Donations and if necessary click on the drop down arrow to reveal more options and select Donations to Charity in 2021. Learn More About Annuities.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. Charitable gift annuities are attractive because they allow you to make donations to the charity of your choice while also receiving a lifetime fixed income stream for yourself or others. That makes sense when you consider only part of the gift annuity is a gift to your charity.

7 rows While charitable gift annuities can provide an initial tax deduction youll still owe tax. Charitable gift annuity tax reporting Sunday April 10 2022 Edit. You get an immediate charitable tax deduction in the year of your gift usually between 25 and 55 of the amount you transfer to charity.

These payments must be reported on your tax return every year and are considered taxable income. Later when you start receiving the annuity payments you will receive a 1099-R from the charitable organization that provides the amount you received for the year. Part of your annuity income is taxable at the federal level and possibly at the state level as well depending on whether the state you live in has an income tax.

Some of the gift annuity is the donors non-charitable right to receive income. This amount will also be reported on Form 1040 Line 7. UAlbany reports fundraising activity on an annual basis to the Voluntary Support of Education VSE survey administered by the Council for Advancement and Support of Education.

A gift annuity is deducted as a charitable donation a component of itemized deductions. The minimum required gift for a charitable gift annuity is 10000. The Charitable Gift Annuity Part Gift Part to Purchase an Annuity When a donor makes a contribution for a charitable gift annuity only part of the gift is tax deductible as a charitable contribution.

On the screen titled Retirement Plan Income - Box 7 select F-Charitable gift annuity from the 7. With a cash donation your annuity income typically will. If the rates published by the Committee on Gift Annuities are used the gift will be at least 50 of the value of the contributed property.

Gifts That Provide Income Maine Organic Farmers And Gardeners

Charitable Gift Annuity Etv Endowment Of South Carolina

Charitable Gift Annuity Thinktv

Charitable Gift Annuities Maryknoll Fathers Brothers

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

How Do I Deduct A Gift Annuity To A Charity

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

City Of Hope Planned Giving Annuity

Charitable Gift Annuities Uses Selling Regulations

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Life Income Plans University Of Maine Foundation

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center